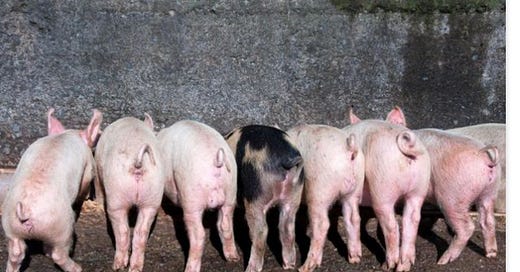

All the pigs at the trough: Some remarks about the collapse of FTX

We're just getting started with this story that will be with us for a while. So much great reporting!

I have written quite a few stories here about the crypto economy and various crypto assets such as tokens, including several stories on ICOs at MarketWatch, stablecoins, NFTs, and bitcoin on public company balance sheets.

Believe me when I say I really did not want to.

I have been a huge crypto skeptic from the start. I thought I could avoid writing abo…