Are the dominant SPAC auditors up to the job?

There's a lot of work primarily flowing to only two firms. Are they getting paid enough to perform their market gatekeeper duties?

There’s been some outstanding reporting on SPACs in the last year, and especially in the last six months.

So, as my former editor at MarketWatch used to say, I had to find my angle on the story. I waited. I don’t do microcaps and I don’t often comment on non-Big 4 auditors. SPACs had previously been combinations of blank-check shell companies with development stage no-revenue-yet microcaps audited by non-Big 4 firms.

But the unmitigated disaster that is Lordstown changed all that.

Lordstown’s auditor since its de-SPAC transaction — the merger with the SPAC sponsor DiamondPeak Holdings Corp — has been KPMG. That finally forced me to pay attention to SPACs. (The previous auditor was WithumSmith + Brown PC, dismissed after the merger.)

I wrote back on June 12 about how Lordstown admitted a “going concern” warning in an amended 10-K, prompted, it seems, by finding $23 million in expenses it had mistakenly capitalized when it went back to restate warrant liabilities per new SEC guidance, like 500 other SPACs.

But that wasn’t all. An SEC inquiry suddenly turned into SEC subpoenas in the amended 10-K, and it appears that executives were selling stock in February, perhaps in anticipation of all this bad news.

And there’s more.

After my Saturday June 12 report on the accounting issues and multiple material weaknesses in internal controls stuffed like leftover gristle you maybe wouldn’t notice into the amended 10-K sausage, Lordstown announced the results of its internal investigation of the allegations lobbed back in March by Hindenburg Research on Monday June 14. The company had also fired its CEO and CFO.

We’ve since been told, first on July 2 by the Wall Street Journal, and now confirmed by the company, that Lordstown is also under a Department of Justice criminal investigation centering, for starters, on the original de-SPAC merger transaction and its now fired CEO’s touting of tenuous pre-orders. The company acknowledged the DOJ investigation by slipping into a recently amended S-1 filing that wrapped in some previous 8-K filings, none of which had previously mentioned a criminal investigation.

The slow disclosure of bad news until forced is a pattern now.

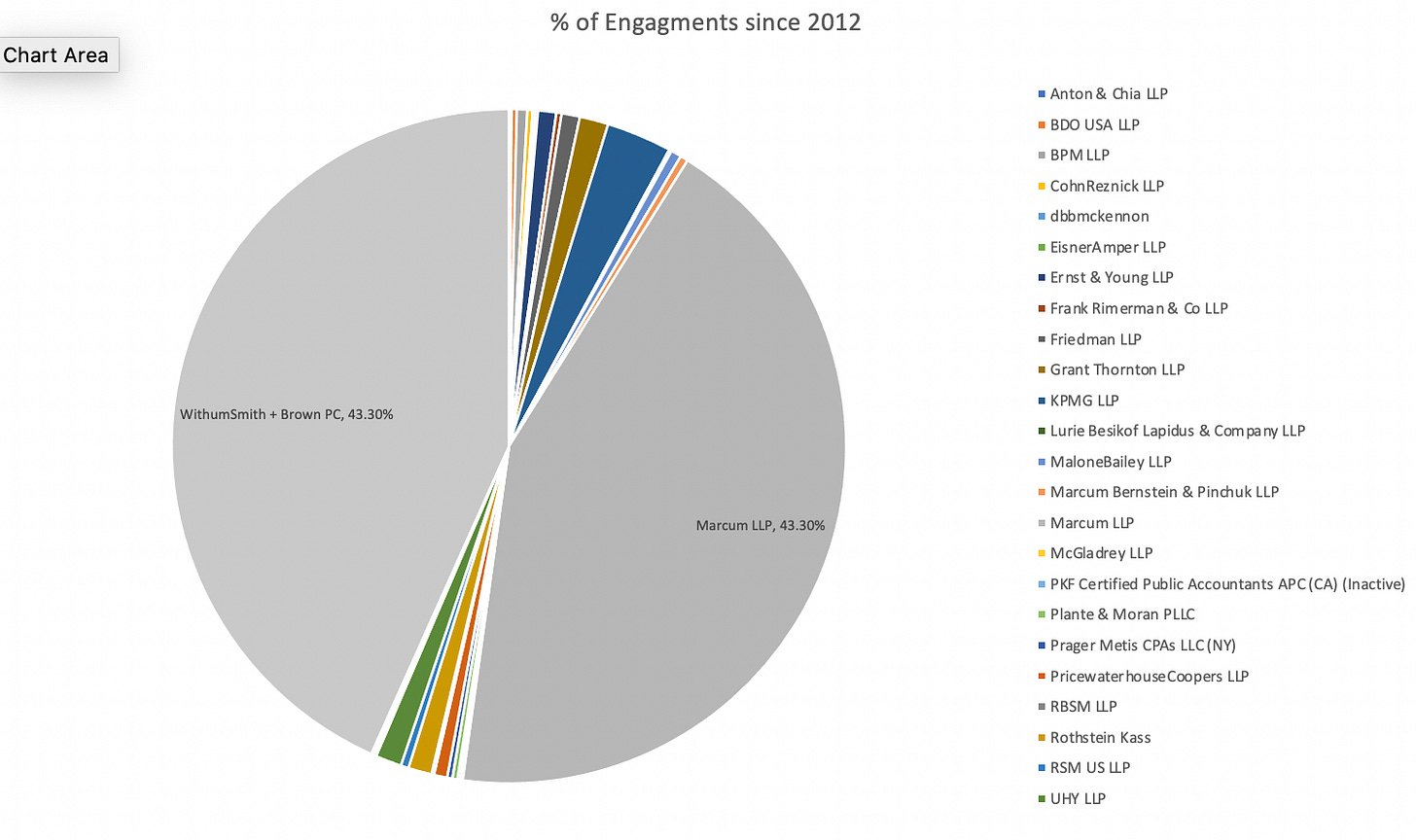

There aren’t very many SPAC transactions audited from shell to merger to launch by Big 4 firms — Deloitte, EY, KPMG, and PwC. Even the largest SPACs have audit opinions signed by partners at primarily one of two firms — Marcum LLP or WithumSmith + Brown PC.

Back in February, Bloomberg’s Nicola White reported that when special purpose acquisition company IPOs hit record volumes in 2020, Withum and Marcum dominated the audits of these blank-check companies.

By volume alone, Princeton, N.J.-headquartered WithumSmith+Brown PC performed the most audits of the shell companies that went public in 2020—138 of 248. New York-based Marcum LLP audited 91. Big Four auditors KPMG LLP and PricewaterhouseCoopers LLP performed seven and one apiece, respectively.

It’s been true for a while that the smaller niche firms dominate the blank-check space.

That is still true and Marcum LLP’s share of the pie has increased in the first six months of 2021.

We looked at the fees being charged by the audit firms for SPAC opinions. SPAC audits can be tough, requiring special expertise that only specialists have, and they have to be done to meet a strict deadline. So, you might expect everyone involved to charge a premium for these services.

Watchdog Research’s Elise Rose did a great job explaining the pressure everyone is under to get these deals on the books:

Typically, the SPAC must use its cash within two years to buy a private company (in a de-SPAC transaction), or refund the money to investors. Generally, investors don’t know what the acquisition target will be until the announcement…

Under pressure, overvalued

As the deadline for a merger approaches, sponsors may have an incentive to complete a transaction on terms where they make money but the retail investor does not. FINRA warned investors of this as far back as 2008:

SPAC managers have a strong incentive to buy a company, even at inflated values, since they will get 20 percent of the company at a nominal price.

If a deal doesn’t go through, the firms that create SPACs must return the money initial investors paid in. The sponsors definitely want to avoid this scenario. So there’s a lot of pressure for SPAC sponsors to find a target company for merger.

The company targeted for acquisition must comprise over 80% of the trust account assets. This creates an incentive for the SPAC’s sponsors to overvalue a target company to get the deal done. If sponsors have relatively little “skin in the game”, they are not harmed, but retail investors don’t get their money’s worth.

Do the deal within two years of raising the funds and make sure you use up 80% of the money raised by investors. Seems like a recipe for a rush job that requires gatekeepers like auditors and lawyers to play a strong role in making sure everything is done right!

Under these circumstances can SPAC sponsors overpay? That’s a story for a later date.

But in the Pershing Square Tontine SPAC deal for Universal Music Group — a deal that blew up on Monday — some said that overpaying may still work if investors can expect a pop with an IPO. When that’s off the table, the numbers may not meet expectations.

When Ackman offered his previous co-investment vehicles to investors in companies such as Automatic Data Processing Inc and Air Products and Chemicals, the allure was the potential pop in the stock once Ackman’s position became public. This will not be the case now as the deal valuing Universal Music Group at $35 billion is already known, and, some of Ackman’s critics argue, overpriced.

“He’s pulled a switcheroo by announcing an investment in a company instead of a merger to take a company public any many investors didn’t like it,” said Erik Gordon, a professor of law and business at the University of Michigan said about the Universal Music deal.

Watchdog Research’s Rose goes on to say that sponsors play an outsize role and get outsize benefits, with the cards definitely dealt in the sponsor’s favor as a result:

Beware the unknown “spouse”

One could think of the sponsors of a SPAC as matchmakers. The retail investor puts money in based on the reputation of the matchmaker, who may have brought about brilliant financial “marriages” in the past.

However, the investor has little to go on but trust in the promises of the matchmaker. The matchmaker is obliged to find a “spouse” (merger target), but it could be an indifferent or even a poor match for the investor.

The matchmaker is guaranteed to make money, and in some cases has undisclosed or even blatant conflicts of interests in the proposed match. The retail investor may end up with no money, no dowry, and an unhappy marriage.

Due diligence is not just the most important thing but, pretty much, the only thing investors need from the SPAC sponsor. That point was highlighted in a post by Matt Kelly, talking about lessons to be learned from the first SEC enforcement action against a SPAC:

With so much money chasing relatively few promising private company targets, that creates the temptation to do a deal quickly, before your 18-month window closes or a competitor SPAC swoops in with a better offer. Corners get cut; red flags are ignored; needed disclosures go unspoken.

Which brings us back to the Stable Road and the spaceship company…

A SPAC’s sole purpose is to acquire an operating company and take it public. In that case, therefore, performing solid and reliable due diligence and passing the results along to investors is the critical task. Providing sufficient time to do that work is part and parcel of the SPAC’s responsibility.

We analyzed the data, available courtesy of research firm Audit Analytics, for audit fees charged by Withum and Marcum and the related legal fees. In some cases the audit fees seem to be lower than one might expect given the premium pricing scenario that SPAC deals present.

Time pressure

Significant specialized expertise required

Limited resources with expertise available within tight timeframe

WithumSmith + Brown PC

One of the two dominant firms in the SPAC audit world, WithumSmith + Brown PC, has been very busy with large and small SPAC clients. Those clients include whale of a client Rush Street Interactive, where Withnum was on both sides of the sponsor/target equation and continues as auditor. They also include multiple cases where the firm turned over the client to a Big 4 firm once the acquisition transaction was completed.

Rush Street Interactive was founded by Neil Bluhm, Greg Carlin and Richard Schwartz to provide online casino and online sports betting in the U.S. and Latin America. It launched its first social gaming website in 2015 and began accepting real-money wagers in the United States in 2016. It currently operate real-money online casino and online sports wagering in Michigan, New Jersey and Pennsylvania, online sports wagering in Colorado, Illinois, Iowa, Indiana and Virginia, and retail sports wagering services in Illinois, Indiana, Michigan, New York and Pennsylvania. In 2018, RSI became the first United States online gaming operator to launch in Colombia, which was an early adopting Latin American country to legalize and regulate online casino wagering and sports wagering nationally.

Rush Street Interactive went public on the New York Stock Exchange in December 2020 after its merger with SPAC dMY Technology Group Inc, raising nearly $266 million. Withum audited dMY Technology Group, Inc. from its inception on September 27, 2019 through December 31, 2019 and also audited Rush Street Interactive, LP as of December 31, 2019 and 2018. Withum continues to serve as auditor in 2021.

Withum billed dMY $49,500 for its work in 2019, which primarily consisted of fees for audit services in connection with its initial public offering. Those fees jumped up considerably in 2020, to $739,995.

In contrast, Withum client Tuatara Capital Acquisition Corporation, a newly incorporated blank check company in the Cayman Islands, wants to be in the cannabis business. The company raised $150 million via its SPAC. Its budget for audit fees is $42,000.

The partner for Rush Street Interactive and Tuatara, Marc Silverman, has been very, very busy this year. Silverman filed 80 audit opinions between January 1, 2021 and July 12, 2021, for 18 different blank check/SPAC companies, according to data filed with the PCAOB. Those opinions were issued for companies headquartered all over the United States and the world — including Chicago, Cayman Islands, New York, Hong Kong, Singapore, Los Angeles, and Greenwich CT — for 2020 annual and quarterly reports and amended annual reports or IPO prospectuses related to the SPACs.

A spokesperson for WithumSmith + Brown PC provided this statement:

Withum has over 70 professionals and 15 partners in its SPAC practice. A majority of Withum’s SPAC management team has been auditing SPACs for over 15 years, positioning us as a thought leader in the industry for a long time.

Marcum LLP

Marcum LLP, the other dominant SPAC audit provider, is the auditor of record for the largest SPAC so far, Pershing Square Tontine Holdings, Ltd., which raised $4 billion to acquire something, anything.

Late Monday night the company filed an 8-K with the SEC saying it would withdraw from its proposed acquisition and distribution to its shareholders of 10% of the share capital of Universal Music Group, UMG. The company’s CEO Bill Ackman, who also leads the hedge fund Pershing Square Capital, explained what happened to Andrew Ross Sorkin earlier that day on CNBC:

Pershing Square Tontine, like all the other SPACs, was required to restate its annual financials filed March 31 in an amended 10-K filed May 24 as a result of SEC guidance about how these shell companies should account for the warrants that come with these deals. To make the corrections, auditor Marcum had to do more work. However, the audit fees disclosed in the 10-K/A vs the original 10-K did not change.

The aggregate fees billed by Marcum for professional services rendered for the audit of our annual financial statements, review of the financial information included in our Forms 10-Q for the respective periods and other required filings with the SEC for the period from May 4, 2020 (inception) through December 31, 2020 totaled $89,301.

Marcum did not bill any other fees to Ackman and Pershing Square Tontine. The company also disclosed in the original 10-K that Marcum had informed it in March that the audit firm had violated auditor independence rules. A tax partner in Marcum’s New York office, the same office where the Marcum partner who signs the audit resides, had acquired 150 shares of Pershing Square Tontine common stock on November 18, 2020 for an aggregate purchase price of $3,590.50, and sold the shares on January 7, 2021 for an aggregate sales price of $4,109.41. That transaction was not permissible under Marcum’s internal policies or the SEC’s independence rules.

The Pershing Square Audit Committee reviewed the facts and circumstances. It concluded that Marcum had violated the SEC’s independence rules. But…

…nevertheless has been and continues to be capable of exercising objective and impartial judgment on all issues encompassed within the audit engagement, particularly in light of the lack of involvement of the “covered person” in the audit or otherwise with respect to us and that the amount involved in the covered person’s trade was not material in amount.

It wasn’t that long ago, in 2019, that Marcum LLP, its affiliate firm Marcum Bernstein & Pinchuk LLP, as well as one of the partners, Alfonse Gregory Giugliano, were the subject of a PCAOB enforcement action that highlighted an auditor independence issue related to its chronic, years-long promotion of audit clients as investments, a blatant independence violation.

In September 2020, Marcum LLP was fined $250,000 by the PCAOB for deficiencies in its quality control policies and procedures regarding initial acceptance of, and audits performed for, certain issuer clients in China. Marcum is prohibited from issuing an audit report for an issuer client with substantially all of its operations in the People’s Republic of China for three years from the date of the report.

The Marcum audit partner for Pershing Square Tontine, David Grossman, has been very, very busy this year. Grossman filed 62 audit opinions between January 1, 2021 and July 12, 2021, 23 of those for blank check/SPAC companies, according to data filed with the PCAOB. Those opinions were issued for 2020 annual and quarterly reports and amended annual reports or IPO prospectuses related to the SPACs.

Marcum LLP has been the SPAC auditor of choice for Chamath Palihaptiya, who The New Yorker magazine called “The Pied Piper of SPACs”. But Marcum did not always survive as the go-forward firm after the business combination.

Marcum LLP was dismissed as the auditor for Virgin Galactic effective November 12, 2019 in connection with the closing of the business combination. KPMG was engaged as Virgin Galactic’s new independent registered public accounting firm for 2019 and billed $732,000 for the audit.

KPMG also billed an additional $315,000 in 2019 for due diligence performed in connection with directors and officers insurance under a contract entered into by Social Capital prior to the de-SPAC transaction.

Marcum billed Clover Health $113,750 for the audit of its annual financial statements, review of the financial information included in our Forms 10-Q for the respective periods and other required filings with the SEC for the year ended December 31, 2020, and billed and $37,500 for the period from October 18, 2019 (inception) through December 31, 2019.

OpenDoor chose its incumbent audit firm, Deloitte, over Social Capital’s audit firm Marcum when the business combination took place on December 20, 2020.

Marcum doesn’t always provide its services so inexpensively or on a limited basis.

On July 1, 2020, Hall of Fame Resort & Entertainment Company, formerly known as GPAQ Acquisition Holdings, Inc. completed a business combination with HOF Village, LLC, Gordon Pointe Acquisition Corp., and several other LLC and entities. The prospectus for an IPO filed with the SEC in February 2021 included the Marcum LLP audited financial statements of GPAQ and HOF Village as of December 31, 2019 and 2018. The opinion for HOF Village contained a warning about the company’s ability to continue as a going concern.

The Company has incurred continuing losses from its operations through December 31, 2019. Since inception, the Company has met its liquidity requirements principally through the issuance of debt. The Company’s cash losses from operations, in addition to its debt due within 12 months of the issuance of these consolidated financial statements, raise substantial doubt about the Company’s ability to continue operations as a going concern.

Although the audit opinion for the company from Marcum for the year end 2020 does not include a “going concern” warning from the auditor, management is still concerned.

While our strategy assumes that we will receive sufficient capital to have sufficient working capital, we currently do not have available cash and cash flows from operations to provide us with adequate liquidity for the near-term or foreseeable future. Our current projected liabilities exceed our current cash projections and we have very limited cash flow from current operations.

The company also says is has material weaknesses in internal control over financial reporting, “according to Auditing Standard No. 5.” (This is an obsolete reference since Auditing Standard No. 5 was renamed by the Public Company Accounting Oversight Board to Auditing Standard 2201 as of January 1, 2017.)

Primarily due to the small size of the Company, the Company does not maintain sufficient segregation of duties to ensure the processing, review and authorization of all transactions including non-routine transactions.

Our processes lacked timely and complete reviews and analysis of information used to prepare our financial statements and disclosures in accordance with accounting principles generally accepted in the United States of America.

For all of this work and extra risk — a business combination, preparation for an IPO, a going concern warning, material weaknesses in ICFR, and a restatement of the warrant liability — Marcum billed $957,121 in 2020 and $490,807 in 2019. The audit partner, Bruce Roff, had only one other client in 2019, Plymouth Industrial REIT, and one other in 2020, Fonar Corp.

David Buzkin, Marcum LLP’s SPAC practice leader, declined to comment on our questions about fees, partner workload and the secret of their success.

How hard is it to do a SPAC audit? Buzkin did comment for Nicola White at Bloomberg back in February:

Blank-check companies are just that: blank. They don’t have factories, equipment, or revenues. So auditing a SPAC is less time consuming and much cheaper than combing through the finances of a company that has warehouses full of inventory, offices in multiple states, or hard-to-value intangible assets like brand names and patents.

“People say, ‘All you do is audit a shell, how complicated is that?’,” said Marcum vice chairman David Bukzin. “But there are certain accounting nuances to the process and there has to be a speed associated with it, in getting it right the first time. We built this machine,” Bukzin said. “It’s almost a seamless conveyor belt, if you will.”

© Francine McKenna, The Digging Company LLC, 2021