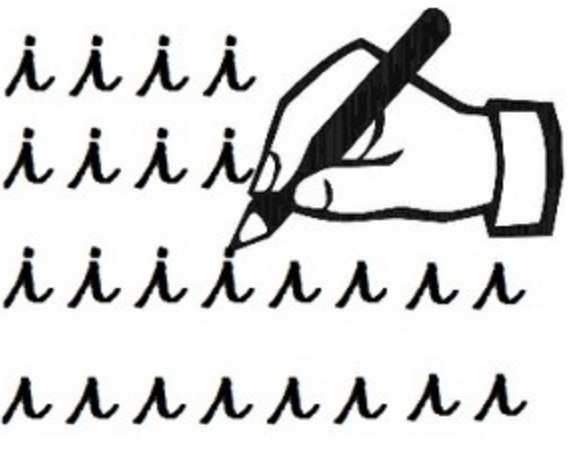

Dotting i's: What can Form AP compliance tell us about 20-F audit quality?

Part 2 of a joint data analysis between The Dig and Deep Quarry looking into whether auditors of foreign issuers fall down on Form AP quality more, less, or differently than auditors of 10-K issuers.

On July 23, 2025 we explored the patterns—and the bad actors—they expose in a population of 10-K opinions filed by issuers in 2023 with no matching Form AP records. We matched the 10-K opinions and Form AP records using (1) CIKs of the issuers and (2) period end of the 10-K report and Fiscal Period End Date field of the Form AP.

For more information about the history and controversy of the audit partner identification in the United States, see our original report:

Our key findings regarding Form AP compliance for 10-K opinions based on our limited sample:

Form AP compliance failures are concentrated: A small number of audit firms were responsible for a disproportionate share of missing, late, or erroneous Form AP filing. Many of these firms later faced SEC or PCAOB enforcement actions for broader audit failures.

Administrative errors signal deeper issues: Inaccurate CIKs, fiscal period mismatches, and inconsistent engagement partner names suggest weak controls over Form AP submissions, with potentially broader quality control issues.

Large firms centralize Form AP submissions; small firms often do not: In larger audit firms, Form APs are typically submitted by a centralized compliance team—often within the National Office—promoting consistency and accuracy. In contrast, smaller firms sometimes rely on individual engagement partners to handle their own submissions.

Our interest in this niche aspect of the regulatory mandate of U.S. audit regulator, the PCAOB, was piqued by the ominous threat to the very existence of the PCAOB and its mission under the Sarbanes-Oxley Act of 2002, including enforcement of Form AP.

After a failed legislative attempt to fold the PCAOB activities into the SEC, last week SEC Chair Paul Atkins fired PCAOB chair Erica Williams. Williams' reform-oriented tenure and, in particular, her stepped-up emphasis on enforcement of PCAOB rules and standards, brought out the critics in droves.

Even one PCAOB Board member, Christina Ho, dismissed a March 2025 PCAOB enforcement action against firms for Form AP violations as trivial...

Did you know the full name of the Sarbanes-Oxley Act of 2002 is "The Public Company Accounting Reform and Investor Protection Act" because its goal is “to enhance corporate responsibility, enhance financial disclosures and combat corporate and accounting fraud”?

Ten years after Sarbox, time for an audit of the auditors

Investors should have confidence that a company is doing what it says it is, says Francine McKenna The Financial Times, JUL 29 2012

So much has happened in just the month or so since we wrote that raises additional concerns about the auditing standards and regulatory reporting requirements for public company auditors already in force. It increasingly appears that already established standards and rules may be up for grabs, along with the future of the PCAOB as an independent regulator.

George Botic, an existing PCAOB board member was announced by the SEC on July 21 as the interim PCAOB Chair, one day before Erica Williams' last day on July 22.

The next day, July 23 — his first day on the job — the Center of Audit Quality (CAQ) sent a letter to PCAOB interim Chair George Botic requesting a deferral in the implementation of QC 1000, A Firm’s System of Quality Control, and other new and amended PCAOB standards, rules, and forms adopted by the Board on May 13, 2024.

On July 25, Reuters reported that SEC Chair Paul Atkins had announced he was soliciting candidates for all PCAOB board member positions, including the chair.

The SEC, which oversees the audit regulatory board, appoints and removes PCAOB members, approves its standards as well as yearly budgets. Atkins signaled that the board’s budget for 2026, as well as board member salaries, will likely be cut.

“The Commission’s review of the PCAOB’s annual budget is an important element of the Commission’s oversight of the Board, and I expect that an evaluation of Board member compensation will be among the items the Commission considers in connection with its review of the Board’s 2026 budget,” Atkins said in a statement on July 23, 2025.

The CAQ — an affiliate of the AICPA that represents accounting firms that audit public companies — saw its wish granted on Aug. 28, 2025, when the PCAOB members voted behind closed doors to postpone for one year, to December 15, 2026, the effective date for QC 1000.

An Aug. 25 deadline to apply for PCAOB seats has now passed but the SEC's new Chief Accountant Kurt Hohl has reportedly, according to the Capital Account newsletter, already compiled a slate for Chair Paul Atkins and his fellow SEC commissioners to review.

Our desire to fully to dig fully into Form AP data was also, in part, prompted by the recent story of Shell plc and its reported audit engagement partner rotation violation. As we explained, despite the audit engagement partner naming disclosures now mandated by Form AP and UK Companies House, it remains a mystery, based on public records, how and why Shell plc engagement partner Gary Donald overstayed his tenure at the company.

Shell plc does not file a 10-K — the issuer population we reviewed in our first report — but a 20-F, the primary disclosure document for foreign private issuers that are listed on U.S. exchanges that is equivalent to the 10-K. Foreign filers likely receive less coverage by analysts and media, partially because the financial statements are typically reported under IFRS or foreign GAAP, which requires a specialized expertise.

With lower third-party monitoring, the independent auditor’s role in ensuring that financial statements are presented according to accounting standards and free from material error, whether due to misstatement or fraud, is even more important.

In this report we review late and missing Form APs for 20-F filers for the same time period — filed by issuers in 2023 with no matching Form AP records — by matching auditor opinions in 20-Fs and Form AP records using (1) CIKs of the issuers and (2) period end of the 20-F report and Fiscal Period End Date field of the Form AP.

Similar to our 10-K analysis, several firms with missing or deficient Form APs were later sanctioned by the regulators for violations unrelated to Form AP deficiencies. Yet, in contrast to the 10-K population, we see more of what appears to be one-off deficiencies rather than a pattern of consistently ignoring the rules.

Behind the paywall we provide our detailed analysis.

Please consider a paid subscription!