Introducing Ozy Media: Following the formula of "fake it until you make it" then collapse in alleged fraud

This time the pitch was "bland Black media," creating a powerful dose of “stars in their eyes” for media and investors.

Once is happenstance. Twice is coincidence. Three times is enemy action. Ian Fleming, creator of James Bond.

In a column after the column that broke Ozy Media, Ben Smith of The New York Times invokes that other charismatic founder and CEO, now on trial in San Francisco for criminal fraud:

There’s an irresistible temptation, in this age of scams and hype, to obsess about the man or woman at the center of a company’s implosion. Theranos’s Elizabeth Holmes was the subject of an HBO documentary, and is now the center of a high-profile trial. And when Ozy Media collapsed on Friday, less than a week after The New York Times reported on a series of misleading statements and actions, all eyes turned to the man at the center of the company, Carlos Watson, an ambitious dreamer who seemed to believe in what he was selling. When he spoke with me over Zoom from a California backyard on Sunday, he conceded nothing.

Tom Fox and Matt Kelly, in the weekly podcast Compliance into the Weeds, go through the incredibly slow then rapid timeline for Ozy Media’s collapse. The company has been around since 2013.

Sunday, Sept. 26: The NYT Ben Smith reveals that an Ozy Media impersonated a YouTube executive on a conference call with Goldman Sachs executives, who were considering investing $40 million in the company.

Monday, Sept. 27: Ozy Media responds that Smith’s column is a “hit piece.”

Tuesday, Sept. 28: Former BBC journalist Katty Kay resigns from Ozy Media.

Wednesday, Sept. 29: Investor and Chairman of the Board for three weeks Marc Lasry resigns from Ozy Media. (The humble Lasry does have some experience with scandal. He was also previously a board member of the Weinstein Cos., the production company of convicted sexual predator Harvey Weinstein.)

Thursday, Sept. 30: Ozy Media hires law firm Paul, Weiss to investigate.

Friday, Oct.1: Ozy Media announces it is closing its doors. Carlos Watson, Ozy Media founder and CEO, resigns from the board of NPR.

Monday, Oct 4: LifeLine Legacy Holdings LLC, which invested more than $2 million in the company sued Ozy, saying it “engaged in fraudulent, deceptive and illegal conduct.” The firm apparently did not see any audited financials before investing.

In 2021, based upon direct assurances concerning Ozy Media’s strong business performance, investments by high profile institutional investors, high viewer metrics, and competent and honest company management, LifeLine agreed to invest in Ozy Media.

The LifeLine suit also says, more than once, that after the impersonation of the YouTube executive on a call with Goldman Sachs to solicit an investment, the company knew that it was the subject of regulatory and/or law enforcement investigations.

Ozy Media also failed to disclose that said high profile institutional investor refused to invest in Ozy Media after learning of said fraudulent conduct and that the company, as a result, was under investigation by various government agencies.

Ben Smith reported in his original column that Google, parent of YouTube, alerted the FBI, and Goldman Sachs then received an inquiry from federal law enforcement officials. The FBI San Francisco field office told Smith in an email that it would not confirm or deny the existence of an investigation.

Also on Monday, Oct. 4, CEO Carlos Watson blitzed the media, announcing the company is coming back. Not everyone was happy, according to the New York Times.

Ron Conway, the founder of SV Angel, a Silicon Valley investment firm, and one of Ozy’s original financial backers, said in an interview on Monday that he was troubled to hear Mr. Watson say he had been in touch with advertisers and investors — but not Ozy employees.

On Monday Oct 4 also: The NYT reported that the investigation of Ozy will not go forward, because the Ozy board members who commissioned the law firm are no longer with the company.

“In your tenure as a business journalist have you ever seen a $40 million company fall so quickly?” Tom Fox asked Matt Kelly on the Compliance in the Weeds podcast. Matt Kelly says he’d have to go back to the dot-com era to see such a dramatic collapse but, maybe, even not then.

Dan Primack at Axios says the Goldman Sachs/YouTube stunt may not be the only problem Ozy has with misrepresentations to potential investors.

Driving the news: Axios has learned that Ozy this year solicited prospective investors by saying Google Ventures has agreed to lead a new funding round, but three sources close to GV say that no such offer was made.

One source says that while GV and Ozy had exploratory conversations in the past, there were none in 2021.

GV declined comment, citing pending litigation.

We've previously questioned details of this "Series D" funding round, which Ozy CEO Carlos Watson is said to have told some employees had been completed. There are no relevant filings with the SEC, nor was there a press release or other public announcement.

My first questions in these cases of private companies touted by the media based on non-financial metrics are: Were audited financial statements ever produced? Did anyone ask for audited financial statements?

At Theranos I reported there were no audited financial statements until the bitter end and no one cared. And I am still the only reporter to interview the Theranos board that presided over the final years and shut-down , on the record, minus Holmes and COO Balwani.

The investors duped by the Theranos fraud never asked for one important thing Founder Holmes raised $700 million from investors but never hired accountants to produce audited financial information Published March 19, 2018 at MarketWatch.com by Francine McKenna

The last days of Theranos — the financials were as overhyped as the blood tests MarketWatch exclusive: Theranos executives, board members and other insiders go on the record for the first time Published Oct. 16, 2018 at MarketWatch.com by Francine McKenna

Just look at how Dan Primack also laments that Ozy Media presented a “wealth creation opportunity” for reporters and how they have been “betrayed.”

I’d call it duped. Not a good look for business journalists.

I had a Twitter interchange last week with another journalist, Eric Newcomer, who publishes his own newsletter after spending six years at Bloomberg and some time at The Information, a subscription-based technology focused publication. Newcomer wrote:

These billionaires are able to buy the truth — at least for a little while. If the press and the public feel compelled to respect private companies based on their valuations, and a single billionaire can set a soaring valuation, then those rich people can declare a private company is worthwhile even though every sane person seems to be skeptical…

So when companies like Ozy and Theranos finally do implode, it’s validating that much of what we were asked to believe based on the whims of some wealthy investors doesn’t match with reality. Then we start wondering about the other companies that we’ve been asked to believe are worth what investors say they are. [Emphasis is mine.]

I had a problem with that:

Sadly, due diligence by anyone — investors or media— is getting worse not better since Theranos. I wrote at The Dig:

What’s the point of boatloads of SEC reporting and disclosure rules, and an audit, if active market participants have no interest or aptitude for reading a 10-Q or a 10-K before investing and don’t care if the financials are audited?

Here’s JPM analyst Stephen Tusa, talking about GE in February of 2019, saying “the stock could go up based on narrative and sentiment,” and no one is reading the 10-K, starting at the 6:15 mark.

“Sophisticated” investors and those who join pre-IPO boards have lately been no better than journalists who gush over start-ups for the sake of scoops with a zeal fed by FOMO, fear of missing out.

Then again, not all celebrity investors serve Carlos Watson’s purpose.

Let’s look more closely at the Sept 9 CNBC interview with Watson and Lasry, a month ago and barely three weeks before Ben Smith wrote his column about the fake-out for Goldman Sachs that occurred all the way back on Feb. 2.

That’s seven months that a whole bunch of people may have known that the subterfuge occurred and that Goldman Sachs had walked away from an investment as a result:

Lasry puffs:

I joined the board a number of years ago. And literally revenues kept doubling every year for the last three years…You want to end up supporting people you think are pretty unique and different. Carlos is that.

Reuters journalist Lawrence Hurley sums it up:

Ozy Media benefitted from a powerful dose of “stars in their eyes” because it was a media startup with a celebrity investor roster and an opportunity for everyone to say they were supporting Black media.

Here’s Lauren Williams in her own words. She left a position as the top editor at Vox to build nonprofit news organization Capital B for Black audiences with her co-founder Akoto Ofori-Atta.

For me, a Black media entrepreneur, it’s a little more meaningful than that — a stark reminder of the type of company and content that attracts the big money and how few profitable paths exist for serious Black news. Marsha Cooke, Vice Media senior vice president of global news and special projects (and a Capital B board member), said in a presentation last year that an agency representing a large entertainment company sent Vice a keyword block list that included “Black people.” Try monetizing that as a Black publication.

Eric Newcomer also bemoaned those who paint all Silicon Valley start-ups with the Theranos brush.

There’s a meaningful difference between the world where the potential fraud was committed and where it wasn’t.

So I agree in part with Elad Gil’s recent essay about the impulse to over-extrapolate from the Theranos saga:

There is a big difference between drunk driving at 90 mph in a school zone versus driving 5 miles too fast on the freeway. (Or, in the case of most tech companies, simply respecting the speed limit).

I don’t know about all Silicon Valley start-ups but I have written about the accounting, audit and corporate governance at a hell of a lot of them and it’s not because there was good news to tell. Ozy Media parallels Theranos in several ways, including the one I am most interested in: Whether there was ever an audit and whether anyone insisted on audited financials for their due diligence.

I could have asked some journalists who covered the company if they had ever seen any audited financial statements but, I think we all know the answer to that question. Ben Smith told me he has “no idea” if there was ever an audit. Smith focuses on scoops, his own words.

That’s similar to how John Carreyrou focused on the medical fraud at Theranos not the financial fraud. Carreyrou also had no idea if Theranos had ever had an audit when I asked him while we both worked for News Corp. He had never heard anyone, including Rupert Murdoch, ever mention an audit at Theranos.

I asked almost everyone else if Ozy Media had paid a public accounting firm to produce audited financial statements and/or whether investors had requested those audited financial statements for their due diligence.

Ozy Media: No response.

Marc Lasry: Spokesman declines comment.

Larry Sonsini, whose law firm Wilson Sonsini Goodrich & Rosati acted as general counsel for Ozy Media until the end of 2018: “We served as corporate counsel to Ozy up to around the end 2018 or thereabouts. We do not audit Financial Statements.”

Emerson Collective on behalf of Laurene Powell Jobs provided a statement that does not address my specific questions: “Emerson Collective is troubled by the allegations against Ozy Media and its senior leadership. Emerson was an early investor in Ozy, but exited the board in 2019 and did not participated in the most recent investment round. Representatives will not further comment at this time.”

Investor SuRo Capital: No response.

The attorney for LifeLine Legacy Holdings LLC: No response.

I also asked the four largest global audit firms if they provide any services — audit, tax or consulting including M&A — to Ozy Media. I was particularly interested in getting an answer from PwC, since Marc Lasry’s hedge fund firm, Avenue Capital, uses PwC as its auditor, according to its latest Form ADV filed with the SEC.

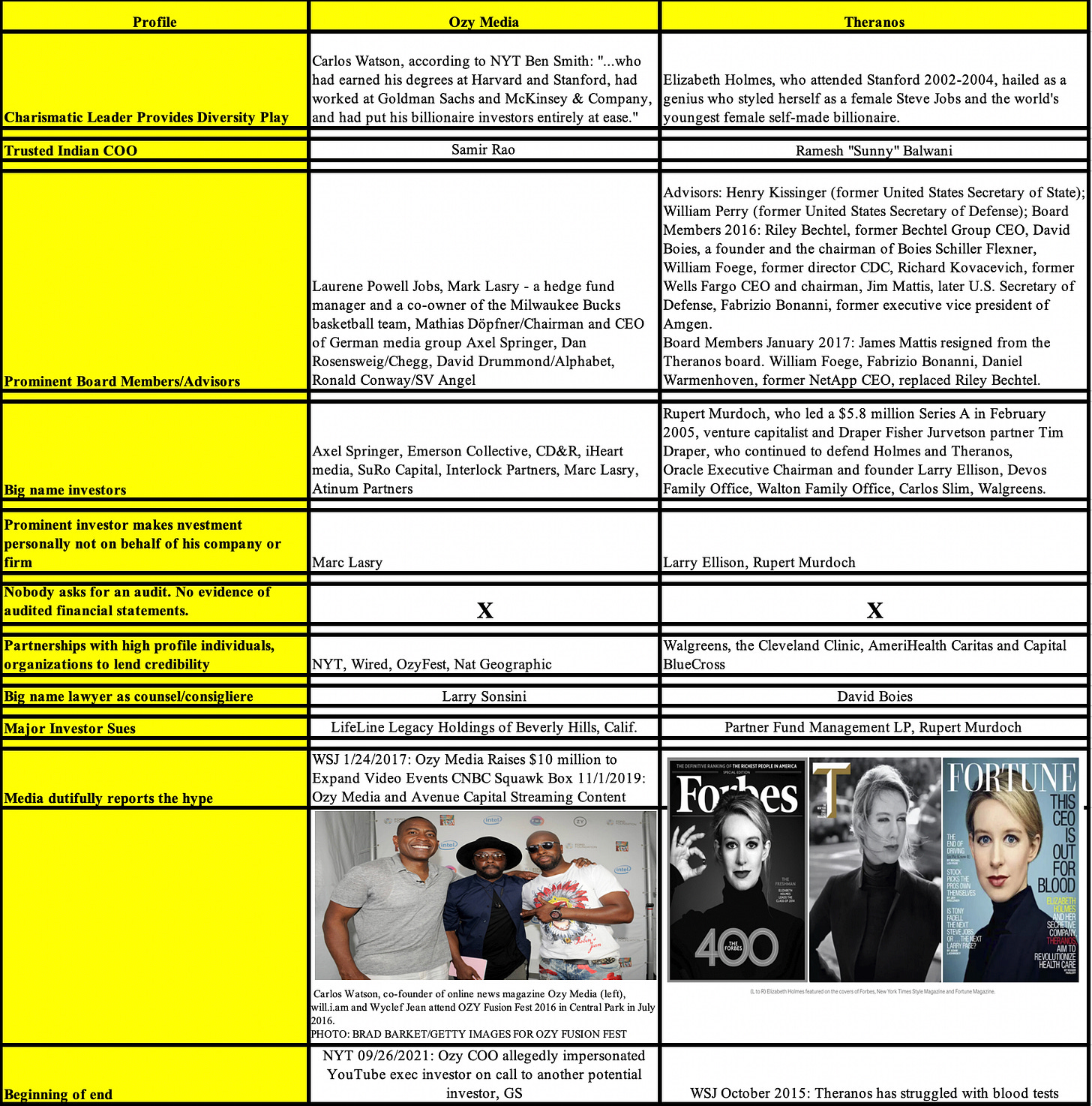

But Axios reported Lasry’s investment was personal, not on behalf of his firm. I did not receive a response from any of the four largest global audit firms — Deloitte, EY, KPMG, or PwC. Here’s a chart I put together with all the parallels between Ozy Media and Theranos.

Update: A spokesman for EY said that the firm does not do the Ozy Media audit, but did not comment on any other services.

© Francine McKenna, The Digging Company LLC, 2021