KPMG's rocky relationship with Banc of California

Banc of California fired KPMG in 2019. Did Banc finally have enough of KPMG's years of reactive criticisms or did Banc suddenly realize KPMG had been punishing its client for its own mistakes?

You may have heard about market ups and downs for Banc of California (BANC) because you saw the bank mentioned by Bloomberg on December 10, 2021, as an issuer the Department of Justice is reportedly investigating with regard to hedge funds and activist short-sellers.

Underscoring the inquiry’s sweep, federal investigators are examining trading in at least several dozen stocks, including well-known short targets such as Luckin Coffee Inc., Banc of California Inc., Mallinckrodt Plc and GSX Techedu Inc. And they’re scrutinizing the involvement of about a dozen or more firms -- though it’s not clear which ones, if any, may emerge as targets of the probe.

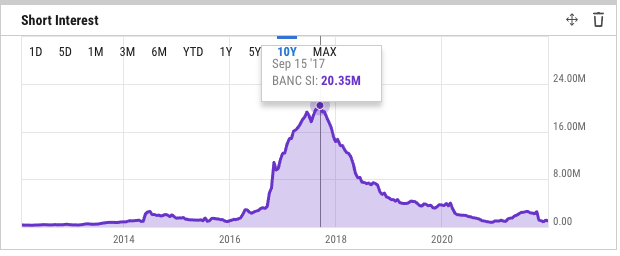

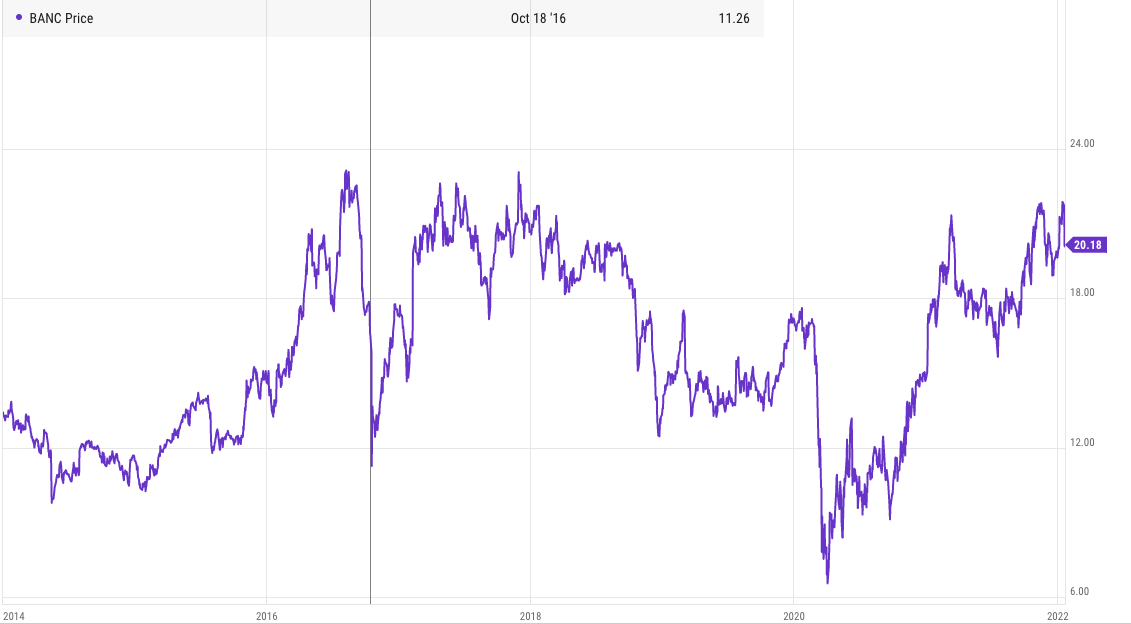

If you have been following the short-interest in Banc of California, you know about the October 2016 publication of a blogger’s allegations against the bank and several of its executives in Seeking Alpha. But that incident was not the peak of short interest in Banc of California.

Instead, short interest was rising throughout 2017, peaking on September 15, 2017 perhaps because of the lawsuits Sugarman v. Benett and Sugarman v. Brown, brought by the former CEO of Banc of California against Banc, its board, its former auditor KPMG and its former chief financial officer, among others. Steven Sugarman was the former chairman of the board, president and chief executive officer (CEO) of defendants Banc of California, Inc., and Banc of California, N.A. (Banc).

Banc, its directors, its former auditor KPMG, and its former chief financial officer responded to Sugarman’s suits with anti-SLAPP motions, based on California’s statute intended to deter “strategic lawsuits against public participation,” or “SLAPPs,” arising from protected speech. The trial court granted KPMG’s anti-SLAPP motion and granted in part and denied in part the former chief financial officer’s motion, leaving Banc, its former CFO, and its directors to file the appeal.

The California Court of Appeals held that “state law claims arising out of disclosures in federal SEC filings may be subject to California’s anti-SLAPP statute, giving defendants a powerful tool to dispose meritless claims early in the process,” according to a write-up by law firm Sheppard Mullin that brought the cases to my attention.

This great write-up concludes:

Because Benett and Brown hold that the anti-SLAPP statute applies to claims arising out of statements made in Forms 8-K, 10-K and 10-Q, they provide another arrow in the proverbial quiver for defendants faced with California state law claims arising out of statements in disclosures to regulators, particularly to the SEC.

That said, it is important to recognize the limits of these cases: they did not hold that “all statements to a regulator are protected,” leaving some room for creative arguments by future plaintiffs’ counsel, particularly under subdivision (e)(4).

Former Banc executive Sugarman’s claims against the defendants were related to statements and press releases made by them to the public and to each other and in filings with the SEC related to the blogger’s October 2016 allegations.

On October 16, 2016, an anonymous blogger calling itself Marcus Aurelius alleged Banc and senior officers and directors had extensive ties to Jason Galanis, who was eventually sentenced to 189 months in prison for his role in a scheme to manipulate the market for Gerova Financial Group, Ltd. a publicly traded company listed on the New York Stock Exchange, and for defrauding the shareholders of that company and defrauding the clients of an investment advisory firm.

(Charts in this article reflect activity in Banc’s share price around the days — in bold— when key news was announced.)

Banc of California immediately began an investigation of the blogger’s allegations. Banc announced on March 1, 2017 it had received a “notice of formal investigation” from the SEC on January 17, 2017.

The bank’s own independent investigation:

…did not find evidence that the individual named in the blog posts had any direct or indirect control or undue influence over the Company. Furthermore, the inquiry did not find any violations of law or evidence establishing that any loan, related party transaction, or any other circumstance impaired the independence of any director. However, the Special Committee did find that certain public statements made by the Company in October 2016 regarding its earlier inquiry into these matters were not fully accurate.

Sugarman resigned as chairman and CEO of Banc on January 23, 2017.

Some may remember that Banc of California was one of the KPMG audit clients I exposed on June 20, 2018 in relation to the KPMG/PCAOB regulatory data theft scandal.

The Justice Department in January brought criminal charges against five former KPMG executives and one former regulator [on January 22, 2018] for allegedly taking advantage of advance notice of regulator inspections. Court filings made June 8 by lawyers for two of the KPMG partner defendants spells out [some of] the audit clients caught up in the scandal. They’re mostly financial companies: Citigroup , Credit Suisse, Deutsche Bank, Banc of California, BBVA , Chemical Financial Corp. , Ambac, Phoenix Life, NewStar Financial, and C&J Energy Services.

The KPMG-PCAOB scandal had initially been made public with a vague press release by KPMG in April of 2017 and then blown open with indictments unsealed on January 22, 2018.

A spokesman for KPMG provided the following statement to me at the on June 20, 2018:

It is important to note that the inexcusable actions of the individuals who were separated from KPMG over a year ago were designed to subvert the PCAOB’s inspection process, and had no effect whatsoever on any of the firm’s audit opinions or clients’ financial statements. Our commitment to audit quality and integrity remains unwavering. In addition, we have taken steps to reinforce our values and culture, and to enhance our governance.

We did not know the names of those KPMG fired or the KPMG audit clients potentially impacted when, on April 11, 2017, KPMG announced that “it had determined that six individuals in its Audit practice, including the head of the Audit Practice, four other partners and one employee, had violated the firm’s Code of Conduct and they are leaving the firm”. The names of the accused were not revealed until the SEC filed civil charges and the Department of Justice unsealed criminal charges on January 22, 2018 against five former KPMG executives and PCAOB employees. Those individuals were accused of stealing “valuable and confidential” PCAOB information and using that information to “fraudulently improve” KPMG’s PCAOB inspection results. Brian Sweet was the sixth defendant — a former KPMG partner and former PCAOB associate director — who pled guilty immediately and agreed to cooperate against the others.

The Justice Department maintained anonymity for the KPMG clients impacted by the scandal until the trial of two of the defendants in February-March 2019. The SEC and PCAOB have never commented publicly on any specific KPMG clients impacted by the scandal and the SEC specifically asked me back in June 2018 not to disclose the client names.

Steven Sugarman’s anti-SLAPP suits and the report of a DOJ investigation into short interest in Banc of California prompted me to go back and look at the history between Banc and its former auditor, KPMG.