Money for nothing: Borgers and its clients

Many of banned auditor BF Borgers' former clients went from the frying pan into the fire after switching to a new firm. But the myriad issues highlighted by the fiasco are nothing new.

Some legislators only wish to vengeance against a particular enemy. Others only look out for themselves. They devote very little time on the consideration of any public issue. They think that no harm will come from their neglect. They act as if it is always the business of somebody else to look after this or that. When this selfish notion is entertained by all, the commonwealth slowly begins to decay. Thucydides

In May of 2024, the U.S. Securities and Exchange Commission issued a order "instituting public administrative and cease-and-desist proceedings pursuant to section 8a of the Securities Act of 1933, Sections 4c and 21c of the Securities Exchange Act of 1934 and Rule 102(E) of the Commission’s rules of practice, making findings, and imposing remedial sanctions and a cease-and-desist order" against Colorado-based audit firm BF Borgers CPA PC, and its sole partner Benjamin F. Borgers, CPA.

The firm and its sole partner were censured and denied the privilege of appearing or practicing before the Commission as an accountant and fined a total of $14 million.

What Borgers did, or rather didn't do at all, is still reverberating through its former "clients" and other audit firms.

I put "clients" in quotes because, although Borgers charged companies money, the SEC said the extent of its actual services from at least January 2021 through at least June 2023 was practically non-existent. It was more than enough to only look 30 months of activity.

This matter involves the deliberate and systematic failure to audit and review public company and SEC-registered broker-dealer clients’ financial statements in accordance with Public Company Accounting Oversight Board (“PCAOB”) standards by PCAOB-registered auditing firm BF Borgers, and its owner and managing member, certified public accountant Borgers, and their fraudulent issuance of audit reports falsely representing that they had done so from at least January 2021 through at least June 2023.

Both the firm and the partner agreed to permanent suspensions from appearing and practicing before the Commission as accountants, effective immediately. I wrote about what happened and some of the collateral damage here:

B.F. Borgers taken out of the game

On May 3 The Securities and Exchange Commission dramatically announced it was cutting public accounting firm BF Borgers off at home plate.

In the SEC’s press release, former SEC Director or Enforcement Gurbir Grewal was brutal.

“Ben Borgers and his audit firm, BF Borgers, were responsible for one of the largest wholesale failures by gatekeepers in our financial markets,” said Gurbir S. Grewal, Director of the SEC’s Division of Enforcement.

“As a result of their fraudulent conduct, they not only put investors and markets at risk by causing public companies to incorporate noncompliant audits and reviews into more than 1,500 filings with the Commission, but also undermined trust and confidence in our markets. Because investors rely on the audited financial statements of public companies when making their investment decisions, the accountants and accounting firms that audit those statements play a critical role in our financial markets. Borgers and his firm completely abandoned that role, but thanks to the painstaking work of the SEC staff, Borgers and his sham audit mill have been permanently shut down.”

My friend and frequent collaborator Olga Usvyatsky wrote about the impact of the enforcement action on the already diminishing number of audit firms servicing penny-stock, micro-cap, and small-cap companies.

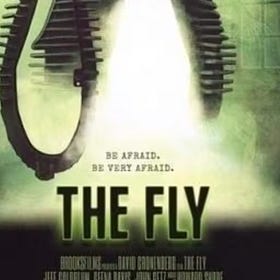

Small audit firms dropping like flies: Self-inflicted wounds or something else?

This is a cross-post with Deep Quarry, the newsletter I occasionally collaborate on with Olga Usvyatsky. If you value our work, please subscribe!

I’ve performed a detailed analysis of the audit firms that picked up the Borgers clients and of the Borgers clients that still haven't found a new audit firm. There are a number of issues I will dig into that emphasize the dismal market landscape which is penny-stock, pink sheet, OTC listings and the audit firms that sign their audits.

After the paywall, going concern zombies, chronic material weaknesses, repeated restatements, flat fees, de-registrations and invalid firms, and audit firms that probably should not have been allowed to take on some of the riskiest, and in some cases skeeviest issuers in the markets.