Shaking the tree: Travels, non-competes, capital structure, FTX, fraud, short-sellers, PCAOB proposals, and trolls

I was never going to get everything I have been sitting on while busy teaching for Univ of Miami into one newsletter. Let's start with this.

Where I have been/Where I am going

I recently spent a week in Coral Gables, Florida live teaching at the University of Miami. My custom-developed course for the MAccs there included teaching our award-winning KPMG-PCAOB teaching case. Looking forward to reading the students' final projects - five accounting/audit/governance issues for a potential IPO - due May 2.

On April 22 I spoke to the Association of Public Pension Fund Auditors Spring conference.

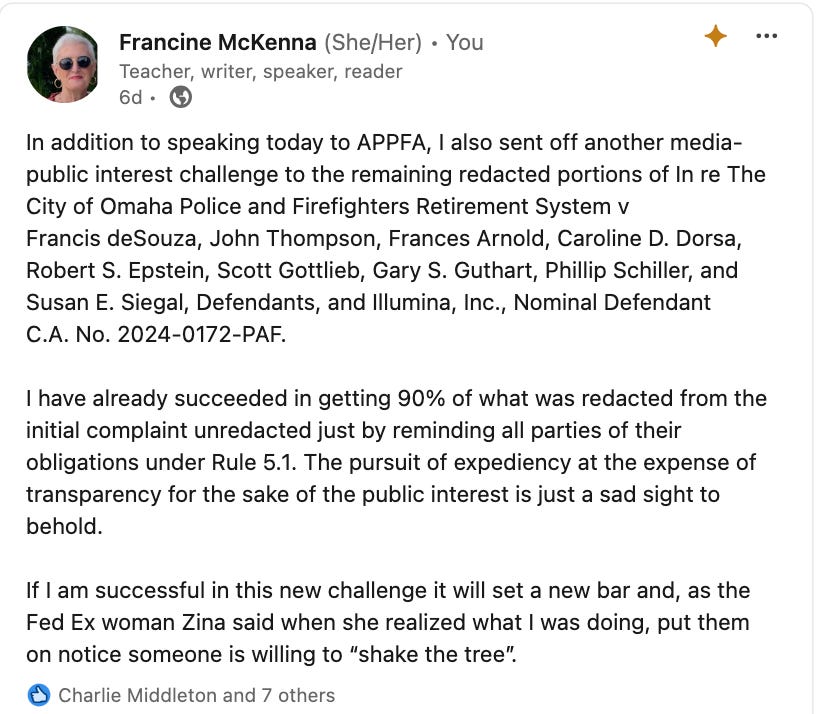

While I was in Chicago, I also worked on this:

Coming up

I'll be back at the end of June for what I think is the 12th time in Los Angeles as a preliminary judge for the UCLA Gerald Loeb business journalism awards preliminary judging.

I will be speaking at the LSU Fraud and Forensic Accounting Conference again this year in July in Baton Rouge.

I have been invited to present our working paper on the PCAOB and its relationship to the SEC at the American Accounting Association Annual Meeting/Ethics Symposium in August in Washington D.C..

Deconstructing the PCAOB: Using Organizational Economics to Assess the State of a Regulator

University of Baltimore - Merrick School of Business

Ohio State University (OSU) - Department of Accounting & Management Information Systems

Ohio State University (OSU) - Department of Accounting & Management Information Systems

Date Written: September 22, 2022

Abstract

Using the principles of organizational economics, we assess the quality of the organizational architecture of the Public Companies Accounting Oversight Board (PCAOB). We use the Four Pillar Framework developed in Brickley, Smith, and Zimmerman (2000) to understand why—according to the SEC’s Chairman Gensler and other stakeholders—the PCAOB may not have entirely realized its mission of investor protection. Our analysis is enabled by the transcripts of the 2019 criminal trial U.S. v. Middendorf and Wada (i.e., PCAOB-KPMG “steal the inspection data” scandal), which for the first time exposed the inner workings of the PCAOB. Our analysis of the transcripts is augmented by other publicly available documents. Our primary conclusion is that the functioning of the PCAOB has been significantly hampered by misalignment of its tasks (in particular in relation to the SEC), sub-optimally designed performance measurement and employee compensation, and weaknesses in the PCAOB’s organizational culture. These misalignments created an environment susceptible to PCAOB employees’ criminal misconduct which enabled the PCAOB-KPMG “steal the inspection data” scandal and other Board governance and leadership challenges.

I have been invited by Professor Mike Willis and Professor Alan Jagolinzer to teach during the Cambridge Executive Masters in Accounting Program residential week this fall, September 16-21. Yes, that is Cambridge, England and I hope to take some extra time to visit my dad's hometown of Glasgow.

And now for the news.