The second coming: The SEC speaks about what comes next

I virtually attended the Securities Enforcement Forum and will be reporting on many of the panels. The first is about the forces of institutionalism against anarchy.

“In the end they will lay their freedom at our feet and say to us, Make us your slaves, but feed us.” Fyodor Dostoevsky, The Grand Inquisitor

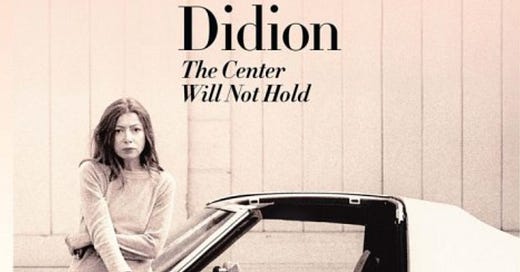

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The Second Coming William Butler Yeats

On Wednesday, November 6, the day after the election here the United States, I sat in my apartment not in Washington D.C. and watched the livestream of the Securities Enforcement Forum D.C. Conference. It bills itself as “a unique, one-day conference that brings together current and former senior SEC officials, securities enforcement and white-collar attorneys, in-house counsel and compliance executives, and other top professionals in the field.”

The Securities Enforcement Forum conference is an incredible success story, organized by old friend Bruce Carton, who puts out the Securities Docket Daily Update newsletter. It’s been held annually in Washington, D.C. since 2012, typically at the historic Mayflower Hotel now that it has grown so big, and also now in San Francisco and Chicago during the year.

I first met Bruce Carton when I started attending the Compliance Week Conference at the Mayflower, a very long time ago, in 2007, the year after I started my legacy blog and when Matt Kelly was still Editor in Chief. I started working with Bruce when when he founded Docket Media and began his rise to former SEC enforcement counsel to the SEC enforcement stars in 2008. The conferences started small, at the Georgetown Four Seasons, and then grew to such a size that it rivals the old Compliance Week multi-day conferences. Bruce, as did Compliance Week and Matt beginning in 2007, has always welcomed me as a credentialed journalist, even when I was an independent blogger, albeit one that is particularly interested and has an aptitude for what he does.

I decided at the last minute not to attend Securities Enforcement Forum D.C. in person this year. I was all flown out from recent trips and had another trip planned for later in the week to Ohio State. I was a bit concerned about D.C. disruptions no matter the outcome of the election and seriously marveled at Bruce’s bold move of holding the conference the day after the election.

But these are professionals!

[Editor note: I have edited transcripts from the conference live feed only for clarity and to eliminate repetition, leaving authentic vernacular. I apologize in advance for any errors in diction or phrasing.)

The professionalism was evident from the get-go, as the second panel of the morning was entitled: The Day After: The Impact of the Election on SEC Enforcement.

Bandy, who spent nearly 18 years at the SEC, through multiple administrations and under multiple Enforcement Directors from 2004-2022, before heading to private practice, moderated. She did a great job “keeping the train running”. She led off the discussion by joking, “I feel like I need to start the discussion with a shot of vodka or at least a bloody Mary, but, look, all, all kidding aside. I think there's one thing that's certain based on the events of the last 24 hours that there really is no uncertainty to who will be our next president. And there's certainty that there will be a change of administration at the SEC.”

She then asked, “What does a Trump Administration at the SEC look like? Can we look back to Trump one as a guide for what we, what we may expect during Trump two?” In answering the question herself she noted:

During my time at the commission, it was, what are the parts of the program that have strong bipartisan support? You know, how do we keep the trains moving and get the votes on things like insider trading, FCPA, you know, egregious Ponzi schemes, investor protection cases, things that have bipartisan support, I think will be the goal, in terms of moving the trains on the enforcement docket.

But, you know, let's talk a little bit about just broader shifts. I mean, regardless of the political party, typically no Chair wants to be perceived as reigning over a weak enforcement administration. Some argue that we saw a greater shift in terms of policy priority areas under Gensler than under the prior Clayton administration. Let's not forget that the [Clayton] administration brought Ripple, brought the Tesla case.

What did the others say?