Warren Buffett writes a letter; what he leaves out is notable

The BRK CEO takes a melancholy tone while living with the ghosts, and trying to get out without ever having to be the bad guy

Warren Buffett’s most recent letter to his shareholders has a nostalgic tone and melancholy vibe, perhaps befitting a man of his age and years of business experience.

Buffett admits he makes mistakes.

I make many mistakes. Consequently, our extensive collection of businesses includes some enterprises that have truly extraordinary economics, many others that enjoy good economic characteristics, and a few that are marginal.

Buffett doesn’t mention one recent mistake in his letter.

Berkshire and its board, where Buffett insists on being Chairman as well as CEO because of his dominant share ownership, made a rookie mistake that prompted an official notice of noncompliance with NYSE rules on February 16, 2021. Berkshire’s mistake was to let the company fall out of compliance with the exchange’s rules that require the board to have a majority of independent directors. The SEC filing for the mistake, “ITEM 3.01 Notice of Delisting or Failure to Satisfy a Continue Listing Rule or Standard; Transfer of Listing,” is one typically filed by penny stocks and wayward SPACs.

How did this happen? Independent director Walter Scott, Jr. passed away on September 25, 2021 at the age of 90. And then 96-year-old Thomas S. Murphy, who had been Audit Committee Chair for years until 2020, resigned on February 14, 2022, a couple of weeks before the company’s 10-K was filed.

Mr. Buffett said Monday that Tom Murphy, a friend and business mentor who built a media empire that became Capital Cities/ABC, had called him and said that recovering from a recent bout with Covid-19 convinced him that he would feel more comfortable stepping down.

By the time the proxy was filed, Berkshire had nominated someone to fill the independent director vacancy on the Board.Wallace R. Weitz, age 72, founded the investment management firm Weitz Investment Management, Inc. in 1983.

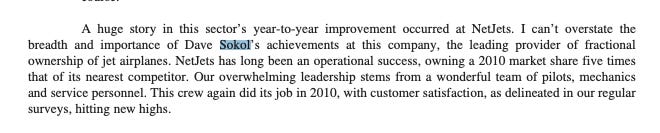

Buffett does mention another mistake in this year’s letter. David Sokol makes an appearance for the first time in forever, at least since his ignominious resignation on March 30, 2011.

BHE’s record of societal accomplishment is as remarkable as its financial performance. The company had no wind or solar generation in 2000. It was then regarded simply as a relatively new and minor participant in the huge electric utility industry. Subsequently, under David Sokol’s and Greg Abel’s leadership, BHE has become a utility powerhouse (no groaning, please) and a leading force in wind, solar and transmission throughout much of the United States.

Buffett had heaped high praise on Sokol in his 2010 letter:

The 2010 letter, ironically, also included a copy of Buffett’s biennial reminder to his executives to “zealously guard Berkshire’s reputation”.

Buffett’s announcement of Sokol’s resignation on March 30, 2011 was a bit unsatisfying in its lack of details.

But not long after, April 12, 2011, the company that Sokol tripped up on, Lubrizol, filed an 8-K with a some more details, then a shareholder filed a derivative lawsuit against Sokol, Buffett, the board and the company on April 18, 2011 in Delaware, and then the Berkshire Hathaway Audit Committee issued a report of an investigation on April 27, 2011, barely a month after the resignation but just in time for the annual meeting three days later, that basically threw Sokol under the bus, saying he had lied to Buffett.

Charlie Munger was not too thrilled, either.

I don’t like any feeling of being victimized. I think that is a counterproductive feeling to think as a human being. I am not a victim. I am a survivor.

Until now Sokol has been a bit of a prodigal son, the name that shall never be spoken or written, but Buffett is feeling nostalgic. You could have had it all, Dave!

Buffett spends nearly 2 pages reminiscing about the recently departed Paul Andrews, founder and CEO of Berkshire Hathaway portfolio company TTI, which was acquired in 2007.

Buffett mentions attending Andrews’ funeral with heir apparent Greg Abel. From the 10-K:

If for any reason the services of our key personnel, particularly Mr. Buffett, were to become unavailable, there could be a material adverse effect on our operations. Should a replacement for Mr. Buffett be needed currently, Berkshire’s Board of Directors has agreed that Mr. Abel should replace Mr. Buffett. The Board continually monitors this risk and could alter its current view regarding a replacement for Mr. Buffett in the future. We believe that the Board’s succession plan, together with the outstanding managers running our numerous and highly diversified operating units helps to mitigate this risk.

Maybe they should not fly on the same plane!

But when was the last time Buffett mentioned TTI or Paul Andrews in his annual letter?

In his 2007 letter Buffett briefly mentions the acquisition of TTI, and in 2008 Andrews makes an appearance in the letter because he will be on the showroom floor with with his 1935 Duesenberg at that year’s “Woodstock of Capitalism” annual meeting. There’s no mention at all of TTI or Andrews in 2009.

In 2010 TTI and Paul Andrews warrant a short paragraph boasting how the company achieved record earnings — up by 127% since its acquisition in 2007 — and another short paragraph in 2011 when TTI hits $2 billion in revenue.

There’s no mention at all of TTI or Andrews in letters for 2012 through 2016 and then the company gets an identical mention in each of the 2017, 2018, and 2019 letters as one of the five companies in Berkshire’s third-tier of non-insurance companies in the conglomerate. That tier, in aggregate, brought in about $2 billion more or less in earnings in each of those years. TTI is now lumped in with five other companies, with no break out for its performance or for Paul Andrews until he died.

The last word from Buffett on Paul Andrews? How Andrews served a purpose for Berkshire Hathaway beyond the contribution of TTI.

The BNSF acquisition would never have happened if Paul Andrews hadn’t sized up Berkshire as the right home for TTI.

Why mention Paul Andrews and TTI now?

Perhaps at 91 years old, with his sidekick Charlie Munger now pushing 98, and his directors dropping off the roster, Buffett is feeling his own mortality. But Buffett selects which stories to tell in a careful manner. There was no mention in his letter of the death last September of longtime director Walter Scott or any mention of the resignation of longtime director Tom Murphy, as a result of a serious bout with Covid-19. Buffett’s letters are a master course in using the right personal stories and colorful anecdotes that, in the end, serve primarily to enhance the myth and legacy of Warren Buffett.