Who's your auditor? Several transactions, two bankruptcies, and Tether raise the question

A variety pack of transactions and two private company bankruptcies cause me to dig in to attempt to answer my favorite question: Where were the auditors?

I just finished reading Professor Erik Lie’s book, Catching Cheats, which came out today, October 7. It’s great!

I noticed that the cases he digs into have a recurring theme: collusion. We often think of some of the big frauds like Madoff or an insider trading case — I’ve written a lot about insider trading by Big 4 global audit firm leaders — as individual efforts, rogue efforts. I started writing about many of the same cases he writes about when I started writing in 2006; Elliot Spitzer, AIG and Client 9, the insider trading cases, and of course stock option backdating which I followed from the auditor involvement angle from the beginning.

I’ll ask him more about this tomorrow when I interview him. Coming up!

In the meantime, while following up on some of his mentions, I found this paper, published in Administrative Science Quarterly in 2012.

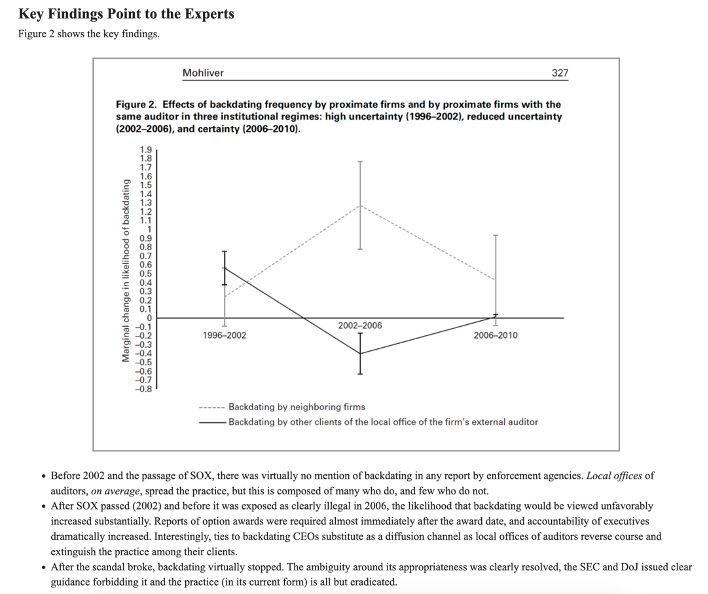

How Misconduct Spreads: Auditors’ Role in the Diffusion of Stock-option Backdating

Administrative Science Quarterly, 64 (2). pp. 310-336 Aharon Mohliver

London Business School - Department of Strategy & Entrepreneurship

Here’s a short version that Professor Mohliver provided for Columbia’s Blue Sky Blog:

The evidence supports two important conclusions. First, professional experts play a role in spreading compromising governance practices, and, contrary to the findings of most research, the relevant unit of analysis is local office rather than an auditor’s head office. Second, professional experts are quick to respond to regulatory changes based on opinions of appropriateness formed from societal signals.

Experts are better at judging where the line separating right from wrong lies, and where it lies when regulations are about to change and then do change. With that ability, those experts can facilitate or, crucially, inhibit widespread misconduct.

When I was writing as a journalist and former senior professional at KPMG and PwC about the auditors and the backdating scandal no one was interested in the auditors role! There were very few cases prosecuted and, in general, it was felt that the decision to prosecute anyone at all was political and a backlash thing, based on response to Enron, etc.

It was very difficult to follow any mentions of the audit firms and partners in the enforcement actions that occurred later. Many executives rejected responsibility saying the practice was blessed by auditors and lawyers, as mentioned. I think this paper is really great in how it describes the change over time in attitudes and, in particular, the critical role of local U.S. audit firm offices in spreading and stopping the practice vs. the efforts, if any, of firm national leadership and headquarters executives such as audit firm General Counsels.

Here are just a few of the articles I wrote at the time:

Judge Rakoff indicts no-fault securities settlement syndrome

You thought backdating was on the back burner

Brocade and backdating; gatekeepers fail

The auditors and options backdating

The rest of today’s newsletter is behind the paywall.

Please subscribe to read more about Tricolor and First Brands auditors, accounting for Berkshire Hathaway’s acquisition of OxyChem, NVIDIA takes a piece of OpenAI, and the candidates for Tether’s financial statement audit firm.