Some links, updates, and commentary on Fiserv and Palantir

For my free subscribers I've got quite a few updates. Behind the paywall I'll talk about two stocks that unexpectedly tanked recently, one on bad news and one on good.

Thanks to everyone who dug into my detailed piece on October 29th on First Brands, BDO, Deloitte and Apollo.

You may be wondering: How does she do it, write so much about such detailed subjects, so often? Well, I just love what I am doing and have few distractions except my pooch Bubbles. So, when I get rolling it just flows. At times, between links, quotes, photos, and various source materials, it feels like I am putting together a grand collage, an assemblage of disparate pieces that I have to review several times to make sure they fit together in a coherent whole.

The work, if my own byline, is unaided by any AI tools.

I was recently asked if I was interested in developing a graduate business school course on how to write better with AI tools. I declined. For now, I will keep working on bringing students with the interest and aptitude for writing better an opportunity to do that via the classes I currently teach.

My friend and frequent collaborator Olga Usvyatsky, of Deep Quarry, has promised to coach me in doing some of the data analysis we do in a faster and more efficient way using AI tools. Until then, my work is handmade. For our collaborations we may at times take advantage of Olga’s skills. All the writing is our own.

Speaking of Olga, she’s put out two excellent pieces in the last week or so that I highly recommend.

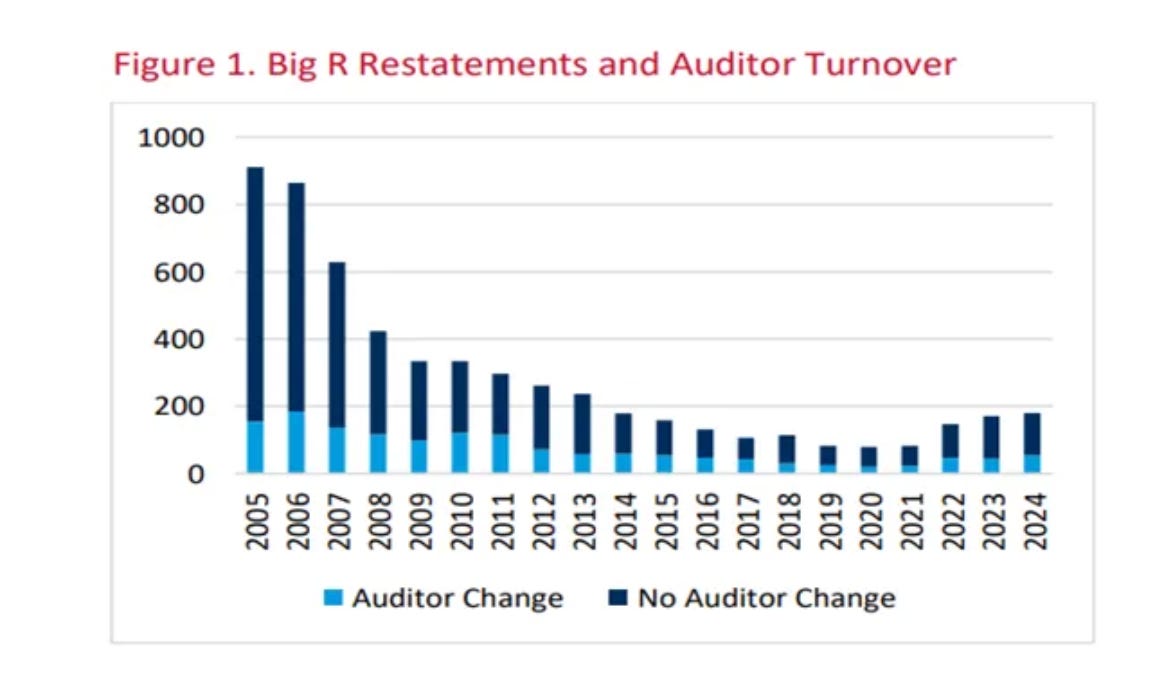

While looking at the connection between Big R restatements and auditor changes, she zeroed in on one firm, Crowe, that seems to be running towards the flames and extinguishing them without hesitation.

From 2005 to 2024, companies that issued Big R restatements were almost three times more likely to have recently switched auditors than the broader market, according to the PCAOB report released on October 15, 2025 (emphasis added):

“On average, just under 30% of these restatements followed an auditor change in the previous year. As a point of reference, the average annual auditor-change rate across the broader population, which includes companies without Big R restatements, was 11%.”

Continuing on the theme of restatements, and the mix of Big R, little r, and out-of-period adjustments and the relationship between these errors and compensation clawbacks, she suggests the following:

The hypothetical assumption about a stable number of total error corrections is a strong statement that is unlikely to hold in practice. Instead, if the clawback rule is prompting managers to exercise discretion and correct more errors as out-of-period adjustments, we should see diverging trends between restatements and adjustments. Alternatively, in the absence of changes in behavioral patterns, we should observe similar trends; that is, if the number of restatements is declining, we should see a comparable decline in the number of adjustments.

Read more about it here.

First Brands

There’s been a lot more news on the First Brands saga I wrote about on Oct. 29. First, the fraud allegations are taking shape in the form of actions against the firm’s founder and control owner, Patrick James.

The Financial Times has the details.

First Brands sues founder Patrick James over alleged fraud Collapse of automotive parts supplier puts spotlight on arcane practice of working capital finance Sujeet Indap and Amelia Pollard in New York Published Nov 4 2025

Lawyers for two different creditor groups have accused First Brands of “massive fraud” in court filings. The lawsuit against James, who resigned on October 13, stems from an investigation launched by the company’s newly appointed chief executive and directors.“Mr. James categorically denies the baseless and speculative allegations contained in the First Brands complaint,” said a spokesperson for the founder. “Mr. James was given no opportunity to respond before the complaint was filed and he intends to immediately challenge it. Mr. James has always conducted himself ethically and is committed to doing everything he can to support First Brands’ stakeholders during the restructuring process.”

On Monday, Quinn Emanuel lawyers representing James said in a court filing that he was in support of a third-party examiner to investigate the company’s financial practices leading up to the bankruptcy filing.

On November 5 Bloomberg reported:

First Brands Group sued founder Patrick James for allegedly misappropriating hundreds of millions of dollars from the US automotive supplier that collapsed into bankruptcy in September.

Lawyers for the company — now run by restructuring consultants at Alvarez & Marsal — alleged that James borrowed funds on fraudulent terms, only to “routinely and regularly” divert cash for himself and his family, according to a Southern District of Texas filing dated Nov. 3. More than $700 million was funneled from First Brands directly to James and his affiliated entities from 2018 to 2025, they claimed.

James “secretly pilfered some of the Company’s assets to fund his and his family’s lavish lifestyle. In short, he lined his pockets at the expense of First Brands and its creditors,” according to the document. The plaintiffs drew on data from more than seven million documents, as well as bank records and a collection of devices from employees.

In the 35-page document, lawyers paint a picture of James’ luxuriant spending habits, pointing to a fleet of at least 17 “exotic cars” and a celebrity personal trainer. In some cases, payments to James and his family were made directly from First Brands accounts, including at least $3 million in rent paid over 2019 to 2024 for a New York townhouse and about $500,000 paid to a private chef in 2025.

On October 30 The Financial Times also had a story about a not-a-big-bank Utah firm that is the biggest creditor to First Brands.

The flashy Utah-based leasing firm that lent billions to First Brands Onset Financial called itself a ‘dominant force’ in financing everything from chickens to helicopters. It ended up as First Brands’ biggest creditor Jill R Shah in Salt Lake City, Eric Platt in New York and Robert Smith and Ortenca Aliaj in London Published Oct 30 2025

Sophisticated private capital firms such as Blackstone have already taken losses on loans made to First Brands, which borrowed close to $12bn to fund an acquisition spree that culminated in one of corporate America’s highest profile bankruptcies in years. But it is Onset, which calls itself “a dominant force” in equipment leasing, that from its base near the foothills of Utah’s Wasatch Mountains has emerged from the wreckage as First Brands’ largest creditor.

Onset says it is owed $1.9bn from the auto parts firm’s bankruptcy estate, with its exposure eclipsing that of prominent Wall Street firms embroiled in the debacle such as Millennium Management.

First Brands’ reliance on Onset, which claims to eschew the “rigid” and “strict” approach of banks in favour of “speed” and “flexibility”, illustrates how unconventional corners of credit markets facilitated its borrowing binge, with many of the Ohio-based company’s lenders unaware of the true scale of its debts until it was too late. Onset told the Financial Times that it conducts “robust diligence” on all its deals, adding that senior executives and independent inspectors visited First Brands facilities as part of the transactions. First Brands declined to comment for this story.

Also on October 30, the Wall Street Journal had another story of how Blackrock’s been burned by more allegedly fraudy asset-based financing.

BlackRock Stung by Loans to Business Accused of ‘Breathtaking’ Fraud An entrepreneur tapped private-credit funds to finance his telecom businesses. Now the lenders say he defrauded them. By Jack Pitcher, Juliet Chung and Soma Biswas Oct. 30, 2025 10:32 am ET

BlackRock’s private-credit investing arm and other lenders are trying to recover hundreds of millions of dollars after falling victim to what they called a “breathtaking” fraud, marking another breakdown in an opaque corner of the U.S. debt markets.

The lenders have accused Bankim Brahmbhatt, the owner of little-known telecom-services companies Broadband Telecom and Bridgevoice, of fabricating accounts receivable that were supposed to be used as loan collateral. The lenders filed suit in August. They said Brahmbhatt’s companies owe them more than $500 million.

Brahmbhatt disputes the allegations of fraud, his lawyer \said.

BNP Paribas helped BlackRock’s HPS Investment Partners finance the Brahmbhatt loans, people familiar with the matter said. A spokesman for the French bank declined to comment.

The dispute centers on a kind of debt deal known as asset-based finance, in which the borrower posts as collateral a stream of revenue generated by specified businesses, equipment or customer receivables. This corner of the debt market has grown significantly along with the rest of the private-credit industry, and in recent months has garnered scrutiny for a pair of sudden auto-industry collapses that left a trail of losses and fraud allegations.

In an earlier story on the impact of these frauds on some regional banks, I wrote that due diligence is dead, as far as I can see.

Let me say it in plain language: Due diligence is dead, and maybe, in a lot of cases, there’s some collusion thrown in to grease the wheels.

Few are checking or monitoring anything before extending billions in credit. That creates serious risks when everyone wants to grow their book of business by leaps and bounds. The potential problems are exacerbated by the remote second, third, or fourth degree relationship that private credit and securitization and structured products create for banks and investors related to the actual goods/services they are investing in or lending against.

The WSJ’s Soma Biswas — who co-wrote the October 30 story — and Sam Goldfarb, say on November 3 that everyone is now on it, there’s been a “reckoning” they write.

Wall Street Intensifies Scrutiny of Fraud After Spate of Loan Losses Lenders are increasing due diligence and demanding access to more data By Sam Goldfarb and Soma BiswasNov. 3, 2025 9:00 pm ET

A string of alleged frauds by corporate borrowers is spurring a reckoning across Wall Street, sending bankers and investors scrambling to prevent future blowups.

Lenders are increasing due diligence and demanding a longer history of financial data from companies. Some are inserting conditions that permit them to do more frequent checkups before agreeing to make loans. A group of the biggest names in banking, investment management and accounting have formed a task force that will take a deeper look at the nature of the problem and how to protect investors...

“This is sending real ripples in the credit markets,” said Colin Adams, partner at Uzzi & Lall, a restructuring adviser that works with both borrowers and financing providers. “People are really starting to ask: ‘How does this happen?’”

How does it happen? Bloomberg’s Matt Levine has a pat answer for that in his column yesterday:

It happens because it is often useful and efficient to be able to finance your business by forwarding electronic lists and getting back money. But sometimes people will take advantage of that.

And by “take advantage” he means to say commit fraud by faking, double pledging, or altering invoices. In other words by committing fraud.

Lest we forget to mention First Brands’ auditor BDO even for a day, the FT delivers more negative news from the firm.

Global accounting firm BDO has quit its role supporting a Singaporean family office that was accused by US and UK authorities of being part of a sprawling international scam empire.

Two employees from BDO — the fifth-biggest accounting network by revenue — resigned as company secretaries to DW Capital Holdings after the US Treasury department imposed sanctions on the family office last month, according to documents seen by the Financial Times. BDO’s Singapore business had helped incorporate DW Capital in 2018 and appointed two of its staff as company secretaries, which handle administrative duties such as business registration. One of the staff included BDO’s head of company secretarial services in Singapore. The BDO employees named in DW Capital’s company filings listed BDO’s Singapore headquarters as their address.

South-east Asia’s position as the centre of a $1tn international scam industry was exposed last month when US and UK authorities announced sweeping sanctions against 146 individuals and companies linked to Cambodia’s Prince Group, which was described as a “transnational criminal empire”. The US government seized $15bn worth of bitcoin connected to Prince Group and charged its founder, Chen Zhi, a 37-year-old Chinese-born Cambodian national, with conspiring to commit wire fraud and money laundering.

BDO was supporting a “transnational criminal empire”? I guess stepping up to the big time means mixing it up with worldwide criminals in the same way that former EY partner Joe Howie has accused EY of doing in his federal lawsuit for retaliatory termination.

Auditors as whistleblowers: When it does, and does not, happen

“In a room where people unanimously maintain a conspiracy of silence, one word of truth sounds like a pistol shot.”

After the paywall, I’ll discuss two recent cases of companies whose share prices tanked unexpectedly Fiserv and Palantir.