8

Share this post

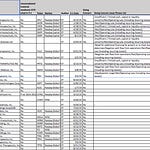

A brazen disregard for public duty: PwC's latest auditor independence mess

thedig.substack.com

10

Share this post

Born yesterday: The mismatch between fundamentals and share price started long before DJT

thedig.substack.com

2

Share this post

Cross-post: Are companies complying with the new SEC compensation clawback rule?

thedig.substack.com

4

Share this post

There's a deluge of news about accounting: ADM, Chemours, Caterpillar, Autonomy, and Evergrande

thedig.substack.com

3

Share this post

Cross-post: More on SEC comment letters and Tesla's tax accounting

thedig.substack.com

The Dig

Francine McKenna digs into accounting, audit, and corporate governance issues at public and pre-IPO companies.

Recommendations

View all 51George Saunders

scott cunningham

Frances Coppola

Doomberg

Matt Stoller

Share this publication

The Dig

thedig.substack.com

© 2024 Francine McKenna

Substack is the home for great culture